Headless CMS scales and improves WPWhiteBoard’s content distribution, flexibility, and personalization

Anurag Mehta

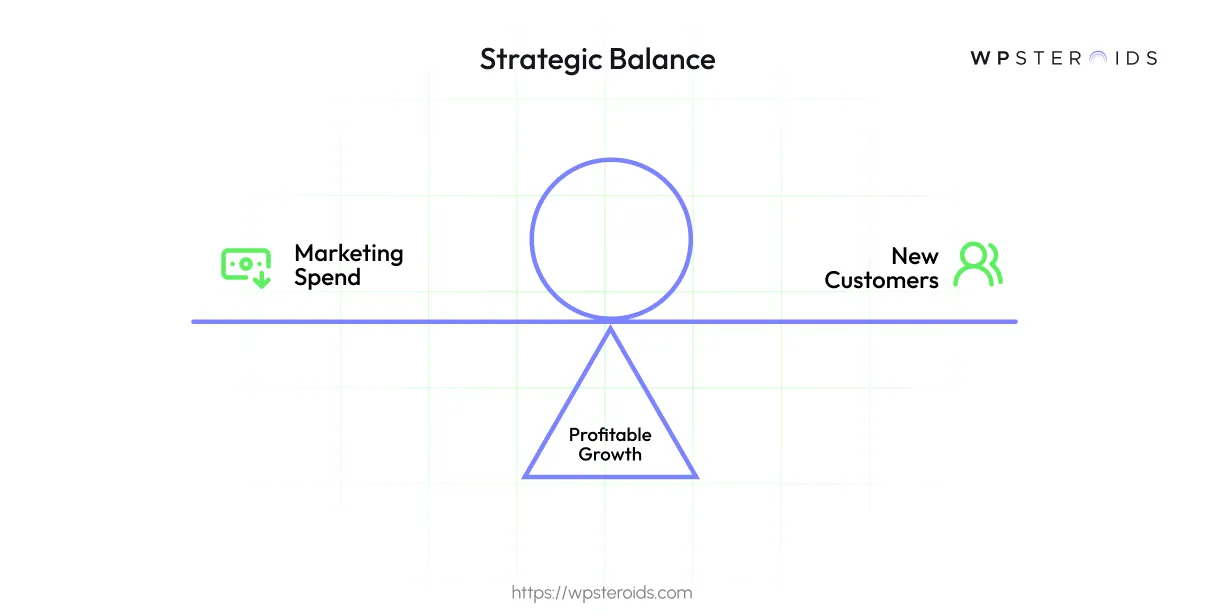

Are you constantly under pressure to justify marketing spend, yet watching your Customer Acquisition Cost (CAC) creep higher? You're not alone.

The default solution is often to cut budgets, but this can stifle growth, leaving you caught between a rock and a hard place.

Slashing your ad budget feels like you’re just choking off your lead flow, but letting acquisition costs continue to rise is unsustainable.

The most effective way to break this cycle is to shift your focus from simply lowering spend to strategically investing for maximum impact.

This guide provides effective ways to decrease CAC by spending smarter.

We'll move beyond a simple checklist to give you a data-backed plan that will help you find more profitable customers, optimize your funnel, and drive sustainable growth.

When the pressure is on to lower your CAC, the most common reaction is to look for the cheapest channels available.

You might start slashing bids, pausing campaigns that seem "too expensive", or shifting your budget to platforms that promise lower costs per click.

But this is often a strategic trap.

A relentless focus on lowering channel cost, without considering the quality of the customer you acquire, is a race to the bottom.

Or worse, what if they convert but have a low lifetime value and churn quickly?

This is a classic case of winning the battle but losing the war. A "cheaper is better" mindset leads to low-quality leads, poor retention, and wasted effort.

This brings us to a crucial strategic pivot. Instead of asking, "How can we lower the cost of our Facebook ads?" you should be asking, "Is Facebook the right place to find our most profitable customers?"

The focus must shift from the cost of a channel to the profitability of the customers it delivers.

An expensive channel can be incredibly efficient if it delivers customers with a high CLV.

Conversely, a cheap channel is a waste of money if it brings in customers who don't stick around.

You can't manage what you don't measure. Before you can effectively reduce your acquisition costs.

The first step is to calculate and reduce customer acquisition cost by getting a firm grip on your numbers.

The Simple Formula to Calculate Customer Acquisition Cost

Let's start with the basics. The formula to calculate customer acquisition cost is straightforward, and understanding this cost of customer acquisition calculation is non-negotiable.

CAC = (Total Sales & Marketing Costs) / (Number of New Customers Acquired)

Total Sales & Marketing Costs: This is the most crucial part to get right. It’s not just your ad spend. To get a true picture, you must include all associated costs within a specific time period (e.g., a month or a quarter).

This includes salaries, creative costs, software subscriptions, and any associated overhead.

Number of New Customers Acquired: This is the total number of new, paying customers you brought in during that same time period.

Knowing your customer acquisition cost can be a phenomenal success or a catastrophic failure.

How do you know the difference? By comparing it to your Customer Lifetime Value (CLV).

CLV is the total revenue you can reasonably expect from a single customer account.

To make this crystal clear, think of your customer acquisition cost (CAC) as the money you put into a vending machine. The customer lifetime value (CLV) is the total value of all the snacks and drinks you get out of it.

If you put in $2 (your CAC) and only get a $1 bag of chips (your CLV), it's a losing machine.

The goal isn't just to find the cheapest vending machine; it's to find the one that gives you the most value. A healthy business model typically sees a CLV:CAC ratio of 3:1 or higher.

Now that you understand the calculating cost of customer acquisition, it's time for action.

Lowering your CAC isn't about one magic bullet; it's about systematically improving your entire customer journey.

This framework is built on three interconnected pillars designed to reduce your acquisition costs while improving customer quality.

The single biggest drain on any marketing budget is paying to reach people who are not, and never will be, your customers.

Sharpening your targeting is the fastest way to stop this waste.

Getting a potential customer to your website is only half the battle. If your digital experience doesn't persuade them to act, you've wasted your acquisition cost.

Every improvement here makes your initial spend more efficient.

A major factor in conversions is page load speed, as slow sites lead to higher bounce rates. One of the most powerful ways to improve performance is to achieve sub-second page loads with headless commerce, an architecture built for speed and a better user experience.

A higher CLV makes your CAC more sustainable and gives you a powerful competitive advantage.

The best way to reduce your net acquisition cost is to get more value from your customers.

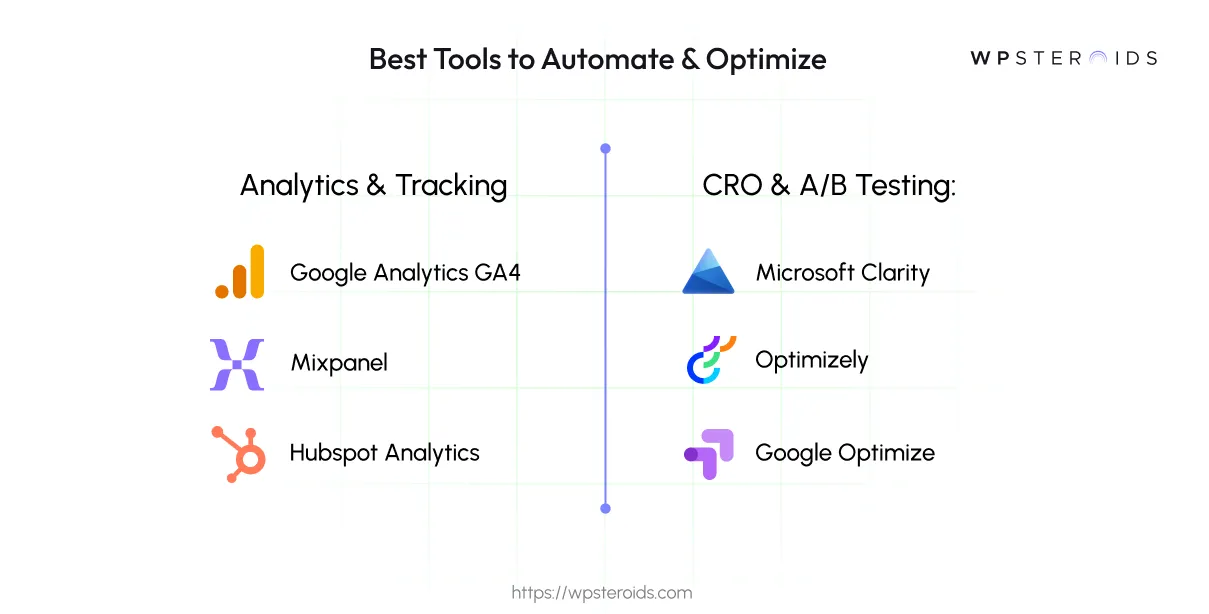

As a data-driven leader, you know that strategy is only as good as its execution. The right technology stack helps you optimize customer acquisition cost at scale. Here are some tips for reducing marketing CAC using technology.

Foundational Platforms: For Ultimate Flexibility: The tools above help optimize your current system, but your core platform can be your biggest bottleneck.

Adopting a headless commerce approach is a strategic move to future-proof your business.

This is especially critical to decrease customer acquisition cost for SaaS businesses that need to iterate on their user experience constantly.

For e-commerce leaders who are serious about long-term agility, the underlying architecture is key.

The pressure to reduce customer acquisition cost isn't going away. But now, you have a new framework to tackle the problem—one that doesn't involve blindly slashing budgets.

The path to lower customer acquisition cost (CAC) is not about spending less; it's about strategic, intelligent investment that begins when you truly know your numbers.

Improving your on-site conversion rate is one of the most effective ways to lower CAC, and there is a direct, mathematical correlation between speed and revenue that can be capitalized on by implementing high-performance technologies like Progressive Web Apps.

By shifting your focus from "what's cheapest?" to "what's most profitable?" you can confidently invest in high-ROI activities. By focusing on the three pillars—Refining your Targeting, optimizing your Conversion Funnel, and Maximizing Customer Lifetime Value—you can build a sustainable growth engine.

This is the strategic pivot is how to reduce customer acquisition cost CAC and prove the immense value your marketing delivers.

Build a more profitable marketing engine. Book your discovery call and start your journey towards customer acquisition cost optimization today.