Headless CMS scales and improves WPWhiteBoard’s content distribution, flexibility, and personalization

Anurag Mehta

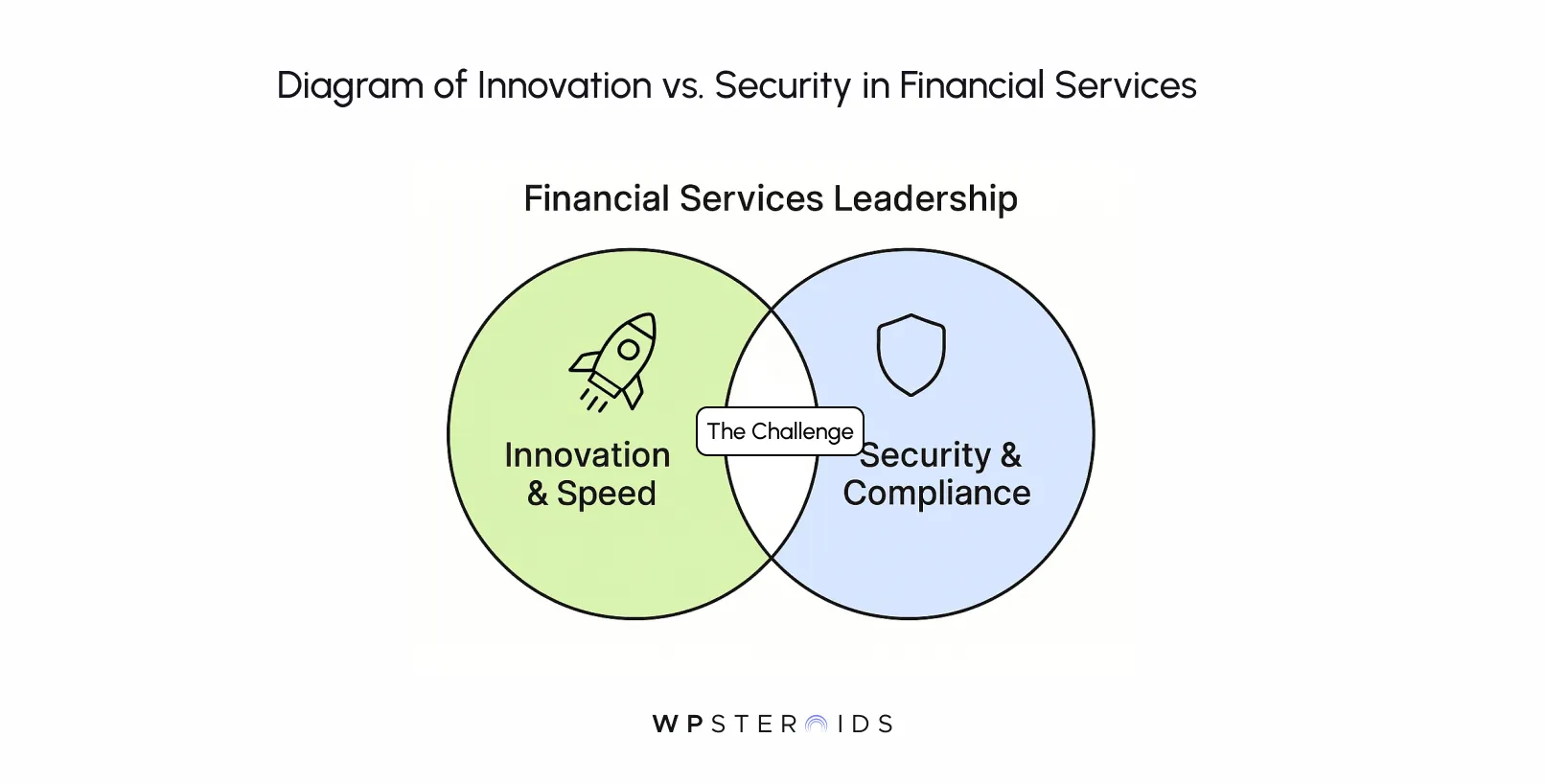

Are your legacy content systems slowing compliance and preventing you from delivering the personalized, omnichannel experiences customers demand? For leaders in financial services, this tension is a daily reality.

You are caught between the relentless need for innovation driven by nimble fintech companies and the non-negotiable mandate for ironclad security and regulatory adherence.

Every delayed marketing campaign, clunky mobile app update, and minute spent wrestling with an outdated platform is a step backward.

A headless content management system (CMS) decouples the back-end content repository from the front-end presentation layer.

This architecture gives financial institutions the security, flexibility, and control needed to manage sensitive data, ensure regulatory compliance, and deliver consistent content across every digital touchpoint—from websites to mobile banking apps.

This is not just a conversation about a tech upgrade; it is a strategic roadmap for the future. Financial institutions have been forced to choose between speed and safety for too long.

It is time to modernize your content management and build a digital foundation that is as secure as it is agile.

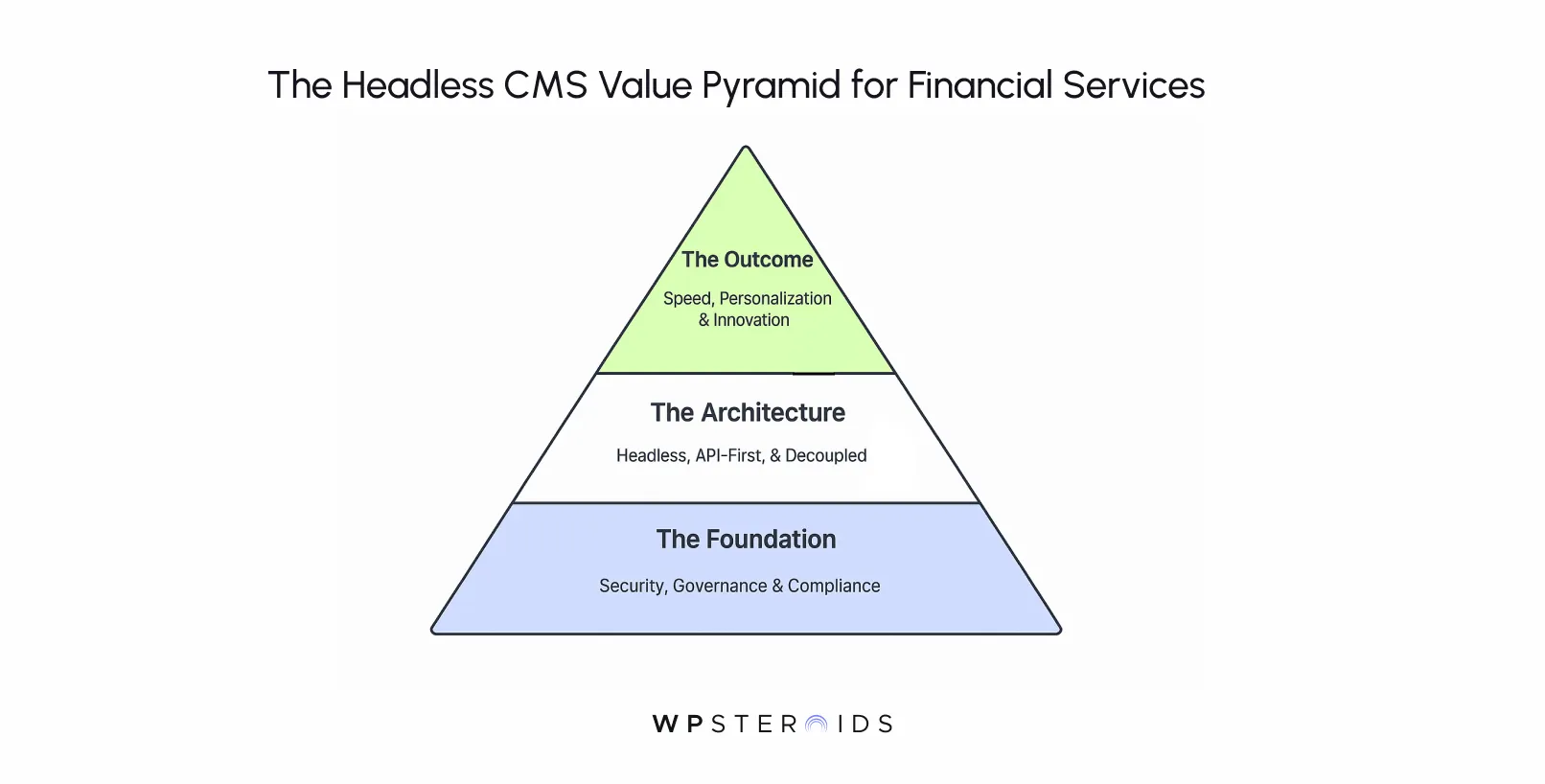

For years, the conversation around content management focused on marketing goals: speed, personalization, and customer engagement. While important, these objectives miss the most critical requirement for regulated industries like financial services.

In an environment where a single content error can trigger a regulatory audit and a security lapse can be catastrophic, the primary function of a CMS must be governance and control. This is where traditional platforms, built for a simpler digital era, fail.

Legacy, monolithic CMS platforms were never designed for the complexity of modern finance.

Their inherent rigidity makes every small update—from changing an interest rate on a product page to launching a new loan promotion—a slow, cumbersome process that requires IT intervention.

This is not just an inconvenience; it is a significant business risk.

It emphasizes that in regulated industries like finance, governance, and auditability—not speed—should be the primary driver for CMS investments.

The strongest return on investment comes not from faster marketing campaigns, but from fewer compliance failures and the avoidance of staggering regulatory fines.

When your teams are constrained by their CMS, you are not just falling behind competitors; you are actively increasing operational risk.

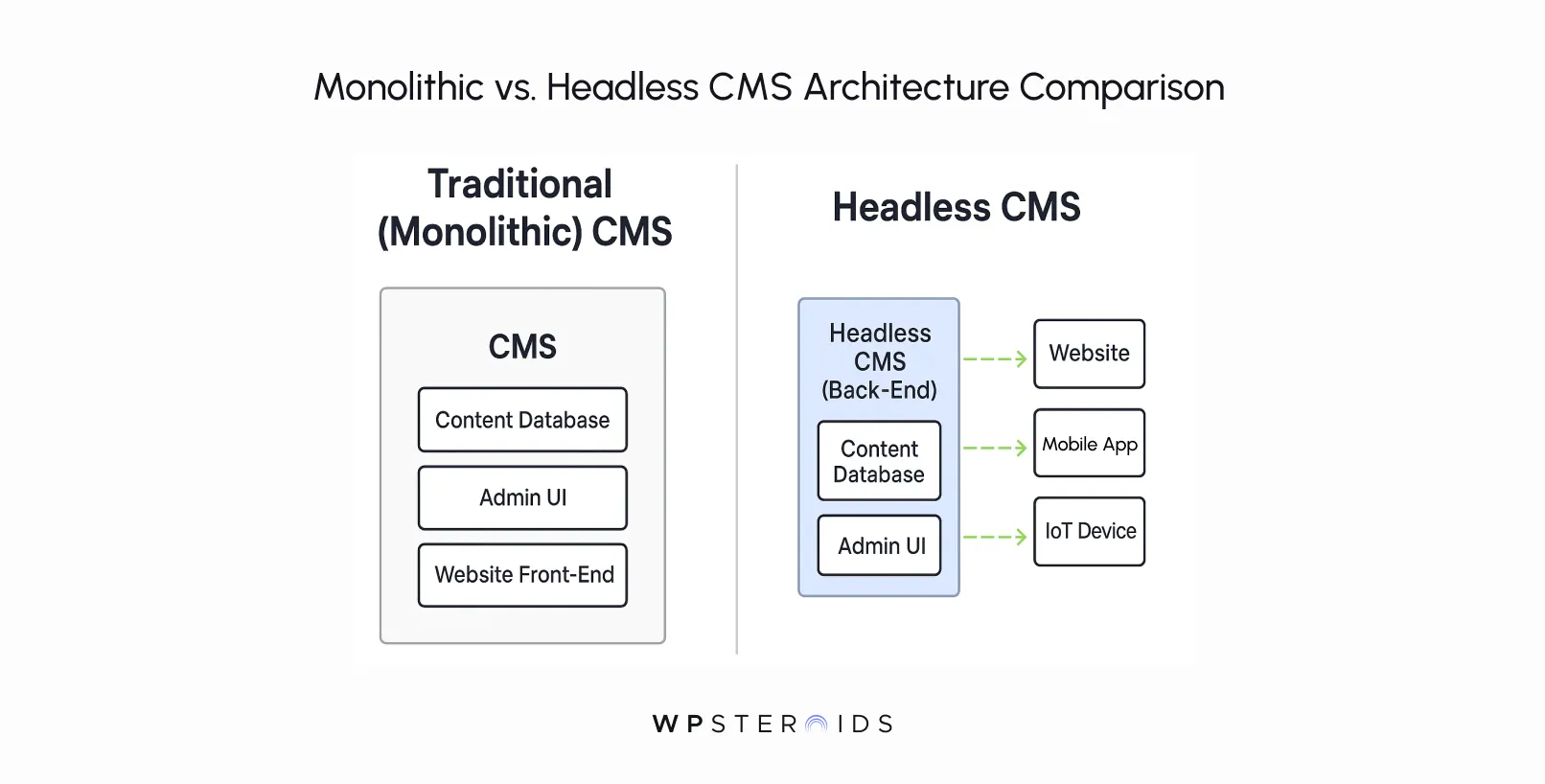

To solve these deep-seated challenges, financial institutions must examine the underlying technology that manages their critical information. The term "headless CMS" sounds technical, but the concept is a direct answer to the industry's need for a more secure, flexible, and future-proof model for content management. It represents a fundamental shift away from rigid, all-in-one systems.

In a traditional, or "monolithic," CMS, the back-end (where content is created and stored) is permanently fused to the front-end (the website where customers see it). A headless CMS breaks this model apart.

It purposefully decouples the back-end content repository (the "body") from the front-end presentation layer (the "head"). All communication between the two happens through secure Application Programming Interfaces (APIs).

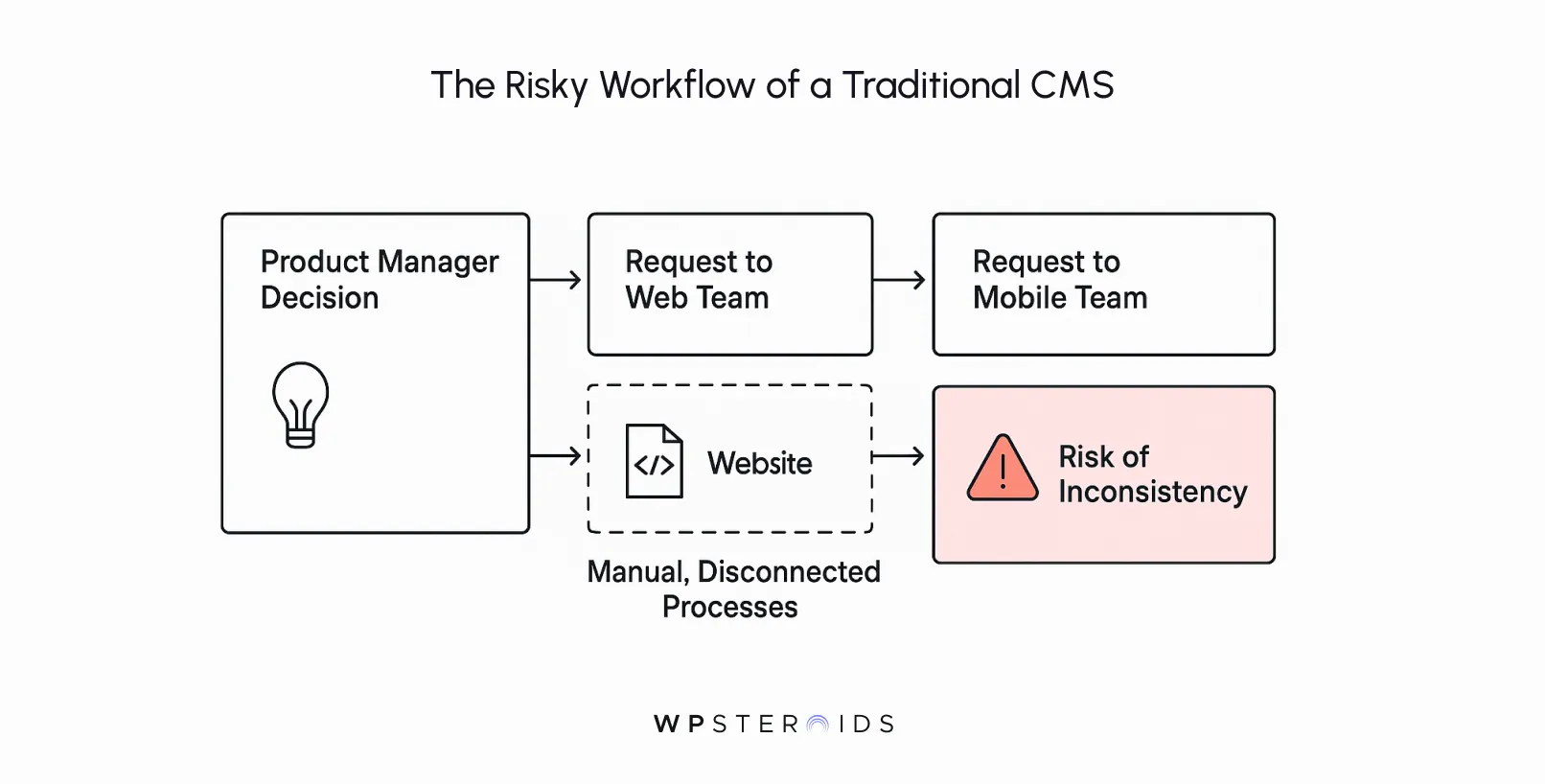

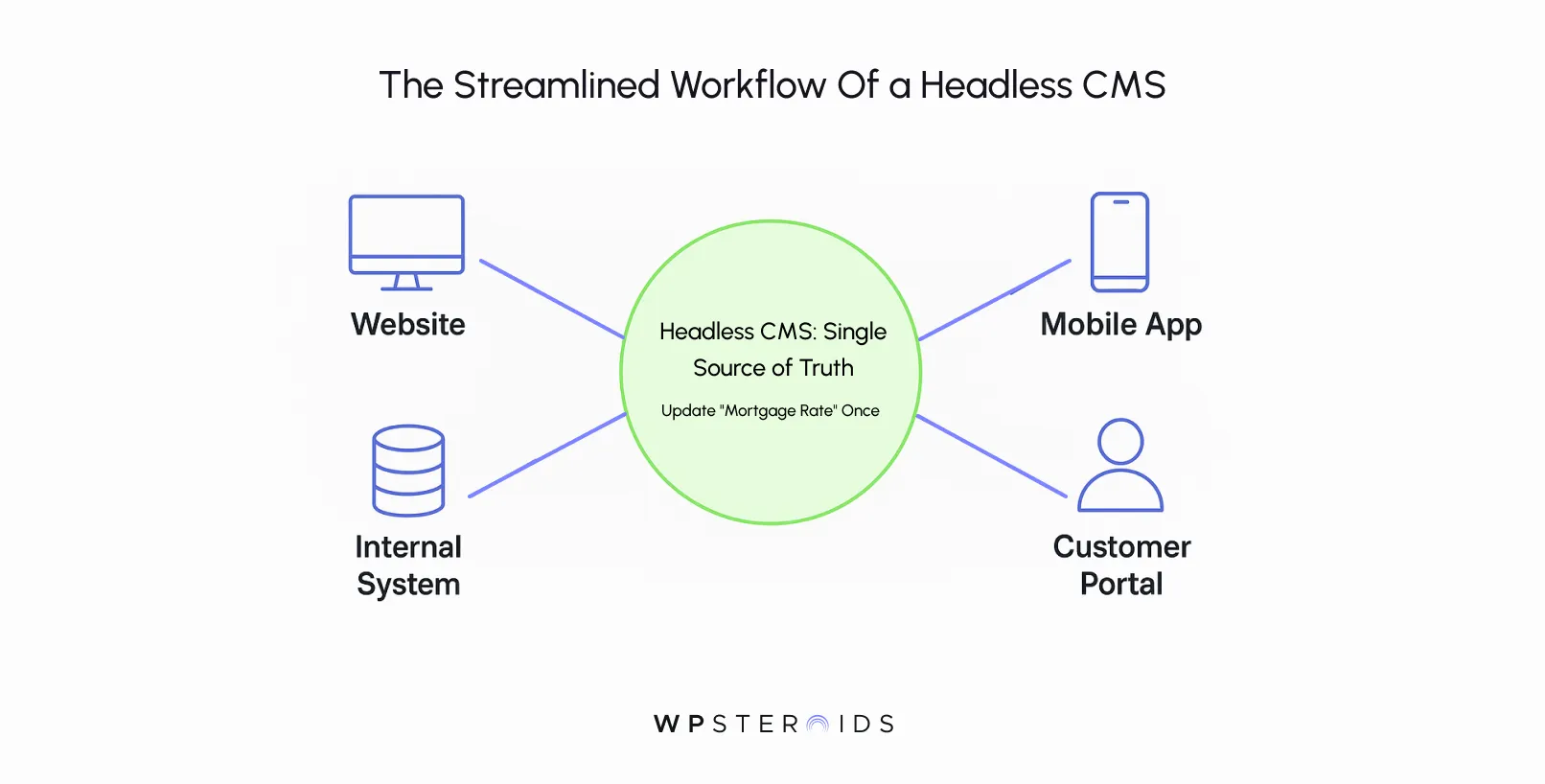

Consider the critical task of updating a promotional mortgage rate.

The Old Way: A product manager decides on a new rate. They send a request to the web team to update the website. A separate request goes to the mobile team to update the app.

The marketing team must be notified. The process is slow, involves multiple handoffs, and introduces significant risk.

What if the rate is updated on the site, but the old rate accidentally remains in the mobile app? This is a major compliance violation and an immediate customer trust issue.

The Headless Way: A compliance-approved product manager logs into the single headless CMS and updates the "Promotional Mortgage Rate" content item once.

The moment they hit "publish," secure APIs make that new rate available instantly. The website automatically fetches and displays it. The mobile app pulls the same data. The change is instant, universal, and consistent.

This model transforms content management from a series of disjointed tasks into a streamlined, reliable operation, drastically reducing the risk of human error for critical financial data.

This API-first approach delivers granular control over what information goes where and creates a future-proof foundation that can adapt to any new digital channel without a complete system overhaul.

In financial services, security is the bedrock of your institution's reputation. A headless CMS architecture is compelling for the industry because its design inherently prioritizes the control, governance, and security that modern finance demands.

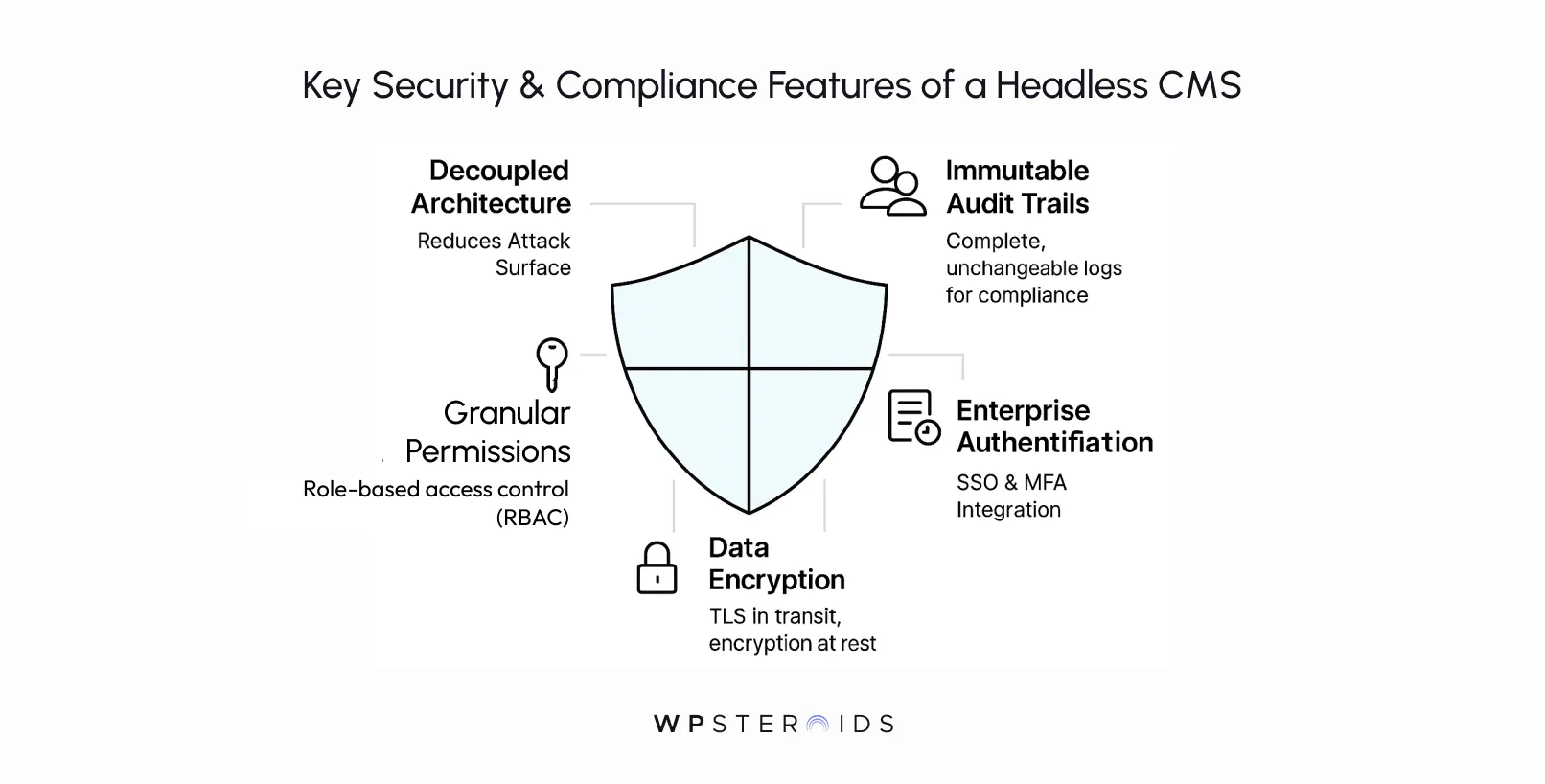

The first and most significant advantage is architectural separation. By decoupling the back-end from the front-end, you create a smaller "attack surface." Your content repository is not directly exposed to the public internet, making it far more difficult for bad actors to target.

Beyond this foundational benefit, leading enterprise platforms offer a suite of critical controls:

For regulations like GDPR and CCPA, the API-first nature makes it far more manageable to build automated workflows that locate and remove customer data from the CMS and integrated systems.

Once the foundation of security and compliance is established, a headless CMS unlocks the speed and flexibility needed to compete and grow.

These are the powerful outcomes of getting governance right first.

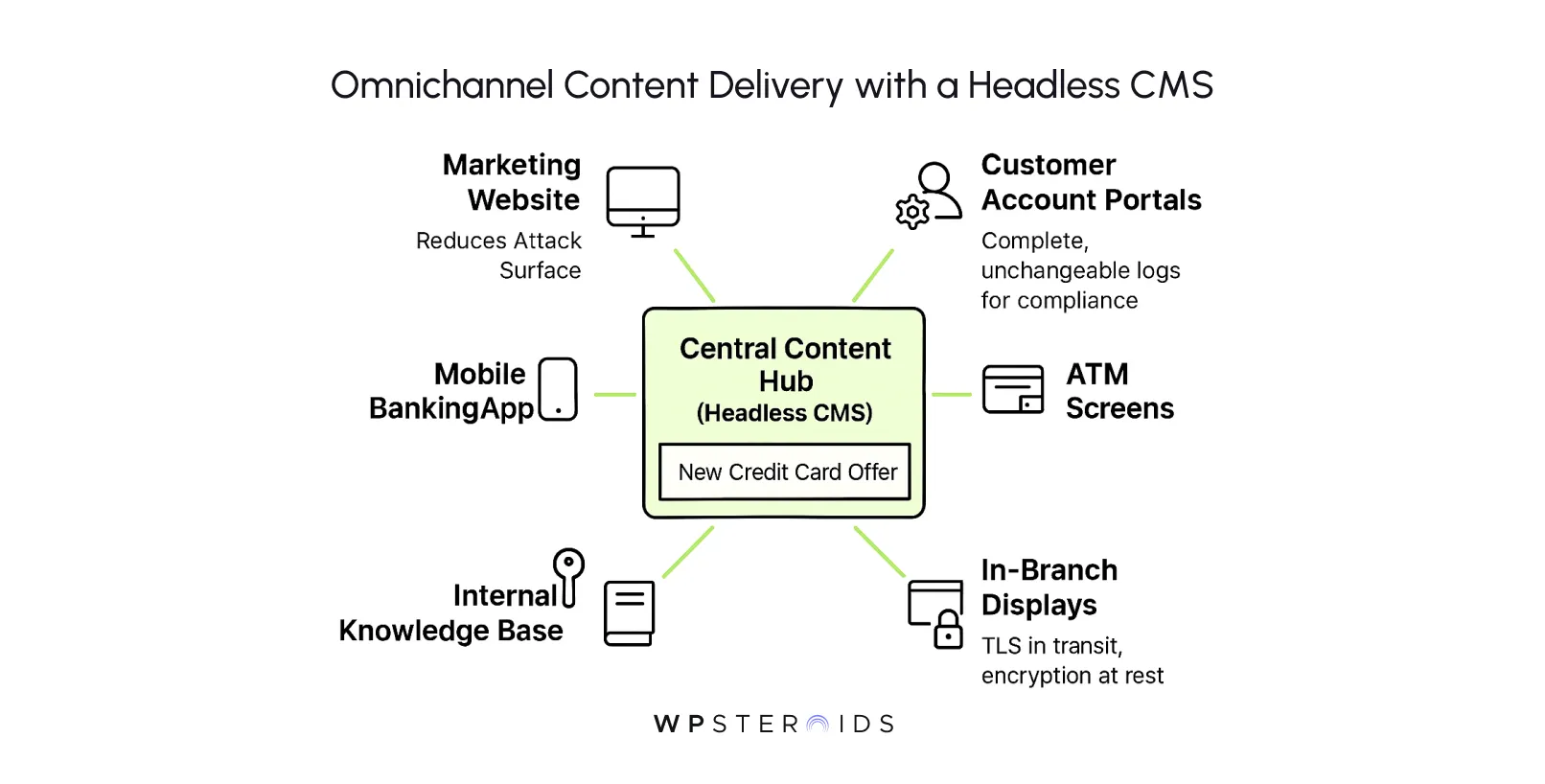

Today’s customers expect a seamless experience, whether on your website, using the mobile app, or visiting a branch.

The "write once, publish everywhere" model means you can manage a single piece of content—like a new credit card offer—and deliver it instantly and consistently across your primary website, secure mobile application, customer account portals, ATM screens, and internal knowledge bases.

The financial world is volatile, and your digital platforms must handle sudden surges in traffic. Because a headless CMS separates content management from content delivery, it offers superior scalability and reliability.

More importantly, this architecture is inherently future-proof. When the next digital channel arrives, you simply build a new "head" and connect it to your existing, secure content repository.

Legacy systems stifle innovation. A headless CMS empowers your teams to build modern, dynamic experiences by integrating content with other best-in-class systems, such as a CRM or a personalization engine.

This opens the door to showcasing wealth management content to high-net-worth clients or displaying mortgage-related content to users browsing home loan pages, thereby deepening customer relationships and providing a competitive edge.

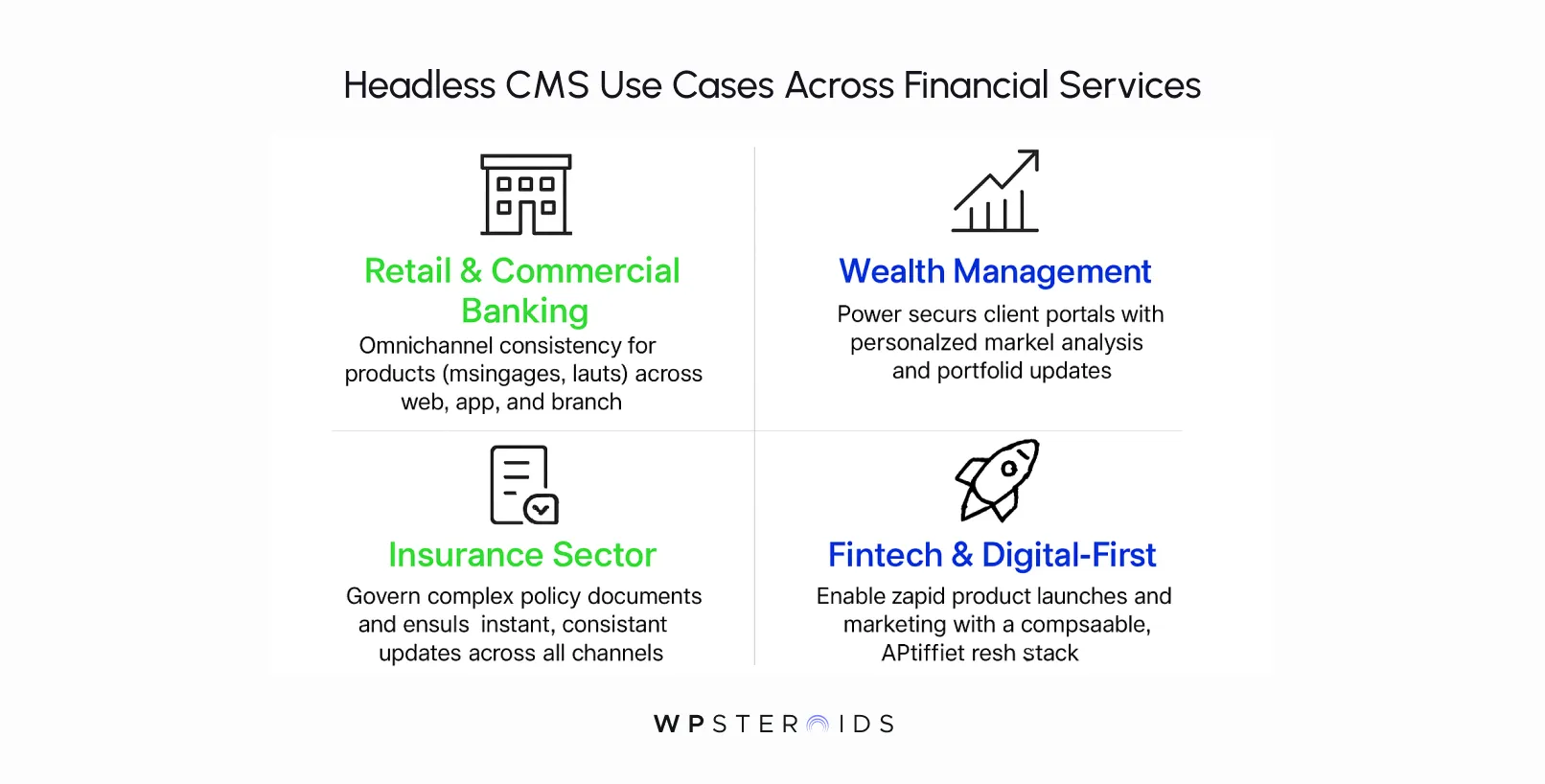

The true value of a headless CMS comes to life when solving challenges across the financial services ecosystem.

The common thread is the universal need to manage sensitive data with precision while delivering modern digital experiences that build trust.

Retail and Commercial Banking: For traditional banks, the primary application is achieving true omnichannel consistency. They manage a vast library of information about checking accounts, mortgages, and loans in one place.

That verified, compliance-approved content is then delivered seamlessly to their marketing website, transactional mobile app, ATM network, and the tablets used by staff in physical branches.

Wealth Management and Investment Firms: Here, the focus is on discretion and personalization.

Firms use a headless CMS to power secure client portals where they deliver personalized market analysis, portfolio updates, and thought leadership content tailored to an individual’s investment profile.

Granular access controls are critical, ensuring a client only ever sees information intended for them.

The Insurance Sector: The insurance industry manages immense volumes of complex documentation. A headless CMS acts as a powerful engine for governance.

An insurer can manage a complex policy document in a structured way. When a regulatory change requires an update to a specific clause, they change it once, and that update automatically reflects across the public website, customer claims portal, and the internal knowledge base used by thousands of agents.

Fintech and Digital-First Finance: For fintech startups, the application is all about speed and agility. They use a headless CMS as a core component of a composable, API-first technology stack.

This allows them to build, test, and launch new digital products and marketing campaigns at a velocity that traditional institutions struggle to match.

After exploring the architecture and benefits, the ultimate question remains: Is this the right move for your institution? The decision requires a careful assessment of your digital ambitions and technical readiness.

First, ask these critical questions: Do you operate in a multi-channel world beyond your primary website, such as mobile apps or customer portals?

Do you have the in-house or agency development talent to build custom front-end experiences? Most importantly, what is the long-term cost of a compliance failure, a security breach, or being too slow to compete?

If these challenges resonate, a headless CMS is a strong strategic fit.

A successful transition requires thoughtful planning. Follow these best practices for success:

The central takeaway is clear: a headless CMS is no longer a niche technology but a strategic imperative for any financial institution focused on long-term security, compliance, and growth.

The core message for your team is this: while the benefits include incredible speed and flexibility, the primary driver for adoption in finance is the commitment to future-proofing your institution.

It is an investment in governance, a safeguard against evolving security threats, and a fundamental pillar for mitigating compliance risk.

The ability to innovate faster is a powerful and fortunate outcome of first building a digital foundation on the bedrock of control and security.

Ready to see how a headless CMS can transform your institution's digital strategy and secure your content operations? Book your discovery call today.

How does a headless CMS enhance security for financial services?

A headless CMS enhances security through its decoupled architecture. By separating the back-end content repository from the public-facing front-end, it dramatically reduces the attack surface. A vulnerability on your website does not provide a direct path to your core content database. Content is delivered via secure, read-only APIs, and the architecture supports essential features like granular access controls, immutable audit trails, and enterprise-grade authentication (SSO/MFA) to ensure only authorized personnel can manage sensitive information.

Can a headless CMS help my institution meet regulatory compliance?

Yes. A headless CMS acts as a centralized content hub, providing a single source of truth that ensures information is consistent across all digital channels. Its structured content models can enforce the inclusion of required compliance information, while immutable audit trails provide a clear, traceable record of all content changes to satisfy regulatory inquiries. This architecture also simplifies the scope of audits for regulations like PCI-DSS by separating content management from payment processing systems.

Is a headless CMS better for performance and speed?

Yes. Because a headless CMS delivers content as lightweight data via APIs, front-end developers can use modern, high-performance frameworks to build incredibly fast websites and applications. Content is distributed globally through a Content Delivery Network (CDN), just like with Contentful CMS, ensuring it loads quickly for users anywhere. The back-end content management operations do not slow down the front-end user experience, resulting in faster page loads and a smoother customer journey.

How does a headless CMS support omnichannel content delivery?

It excels at this by design. A headless CMS uses a "write once, publish everywhere" model where content is stored in a pure, channel-agnostic format. Secure APIs, then deliver that same piece of content to any "head"—be it your website, a native mobile app, a secure customer portal, an ATM screen, or an internal knowledge base. This ensures your branding, product information, and critical disclosures are perfectly consistent across every customer touchpoint.

Is a headless CMS worth the investment for a financial institution?

For financial institutions, the value is measured in risk mitigation and future readiness. A headless CMS is worth the investment if your organization needs to fortify security, streamline complex compliance workflows, and deliver true omnichannel experiences. The upfront cost of development must be weighed against the significant long-term costs of maintaining a legacy system and the immense financial risk of a security breach or compliance failure.

Is headless CMS the future of financial technology?

Yes, particularly for regulated and complex industries. The entire enterprise technology landscape is shifting away from rigid, all-in-one platforms toward more flexible, secure, and "composable" architectures. A headless CMS is a core component of this modern, API-first approach, providing the foundation needed to compete on customer experience while upholding the highest standards of security and governance.

How can a financial institution choose the right headless CMS?

Prioritize vendors with a proven track record in enterprise security, demonstrated by certifications like SOC 2 Type II and ISO 27001. Scrutinize their API documentation, scalability, and integration capabilities. Most importantly, confirm the platform provides essential governance tools, such as highly granular access controls and immutable audit trails. Choose a strategic partner who understands the unique security and compliance demands of the financial services industry.